ReveniQ's

TaxiQ:

Tax Management

Tax Management You Can Count On

Navigating tax obligations can pose intricate challenges, particularly when operating across various countries and jurisdictions. Essential factors in determining the applicable tax include the addresses of both the seller and buyer, alongside the nature of the product being transacted. Additionally, certain countries impose unique tax return formats that must be adhered to.

The complexity escalates when managing transactions across multiple financial platforms, encompassing payment gateways and accounting systems.

Work With Us!

Why Taxiq?

ReveniQ's seamless integration with your financial ecosystem, including platforms like Stripe payment gateway, Xero accounting, and CRM systems such as Salesforce, offers significant benefits:

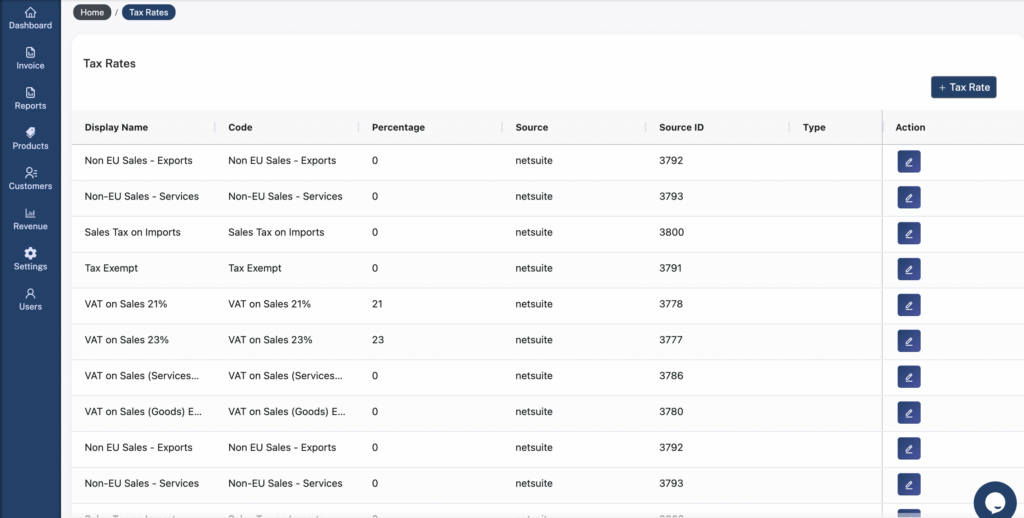

It aggregates tax information from all your platforms, ensuring a comprehensive view of your tax obligations.

ReveniQ allows for the addition, removal, or modification of tax parameters, providing flexibility to adapt to changing tax requirements.

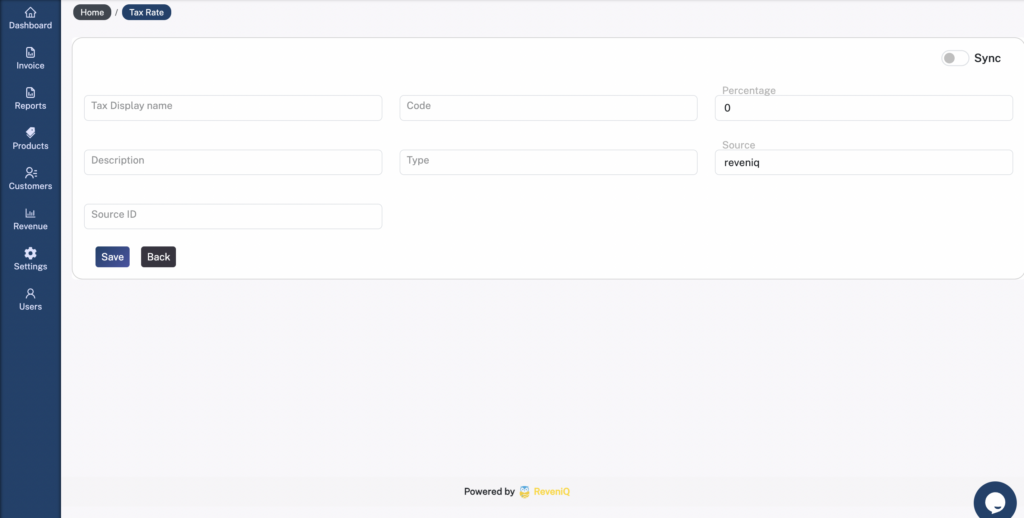

Users can create new tax rules and apply them to invoices as needed, enabling customization to meet specific tax scenarios.

Users can include notes or annotations to tax entries, enhancing clarity and providing additional context for tax-related transactions.

Users can apply partial or complete refund in case of an erroneous payment, creating an automatic credit note across the ecosystem.

ReveniQ ensures seamless synchronisation of any modifications made to tax settings across all integrated platforms, maintaining consistency and accuracy in tax management.

Effective Tax Management

Efficient tax administration forms the foundation of fiscal responsibility, guaranteeing adherence to regulations, maximizing assets, and protecting profitability!