Navigating the Hazards of Spreadsheet-Based Revenue Recognition:

In the realm of financial management, revenue recognition serves as a cornerstone for accurately depicting a company’s financial health and performance. However, the use of spreadsheets for this critical function can introduce a myriad of risks and challenges, particularly for businesses operating in dynamic and complex environments. This article explores the limitations of spreadsheet-based revenue recognition and advocates for the adoption of specialized software solutions to mitigate risks and enhance efficiency.

Risks Associated with Spreadsheet-Based Revenue Recognition

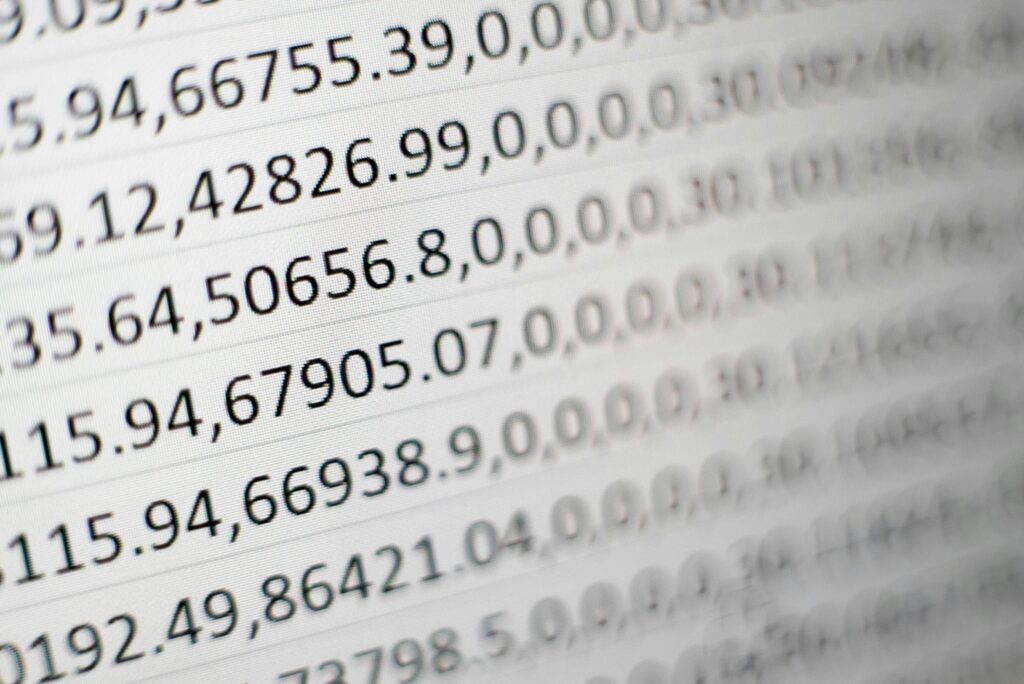

While spreadsheets have long been a staple tool for financial analysis, their suitability for revenue recognition processes is increasingly questioned due to several inherent risks.

Complexity and Error-Prone Nature

Managing revenue recognition within spreadsheets means navigating through intricate calculations and data manipulations, leaving room for manual errors and formula mishaps. Complex revenue recognition scenarios, such as those involving multiple performance obligations or variable considerations, can exacerbate these risks, leading to inaccuracies in financial reporting and compliance violations.

Lack of Audit Trail & Documentation

Spreadsheets lack robust mechanisms for tracking changes and maintaining a comprehensive audit trail, making it challenging to demonstrate the accuracy and reliability of revenue recognition decisions. This deficiency in transparency can impede regulatory compliance efforts and expose businesses to increased audit scrutiny and legal liabilities.

Why We Need More Revenue Recognition Software

In response to the limitations of spreadsheet-based revenue recognition, there is a growing imperative for businesses to embrace specialized software solutions tailored to the complexities of modern revenue recognition challenges. Several key factors underline the need for dedicated revenue recognition software:

Complexity of Revenue Recognition Standards

The advent of accounting standards such as ASC 606 (or IFRS 15) has heightened the complexity of revenue recognition requirements, demanding advanced software solutions capable of interpreting and applying these standards accurately. Specialized revenue recognition software offers built-in compliance features and automated processes to ensure adherence to regulatory guidelines.

Scalability and Efficiency Requirements

As businesses scale and transaction volumes increase, the limitations of spreadsheets become more pronounced, leading to inefficiencies and operational bottlenecks. Revenue recognition software provides scalable and efficient solutions for managing large volumes of transaction data, streamlining processes, and reducing manual intervention, thereby enhancing productivity and agility.

Enhanced Accuracy and Auditability

Specialized revenue recognition software offers robust validation and reconciliation capabilities, reducing the likelihood of errors and discrepancies in revenue recognition calculations. Moreover, these software solutions maintain comprehensive audit trails and documentation, facilitating transparency and accountability in financial reporting practices.

In conclusion, while spreadsheets have traditionally served as versatile tools for financial analysis, their suitability for revenue recognition is increasingly called into question in today’s complex business landscape. Specialized revenue recognition software solutions offer a compelling alternative, providing advanced functionality, scalability, and compliance features to address the evolving needs of modern businesses. By transitioning from spreadsheet-based approaches to dedicated software solutions, organizations can mitigate risks, enhance efficiency, and uphold the integrity of their financial reporting processes.